💰BlackRock just became a Bitcoin whale — quietly.

PLUS: Why is Alphabet cheaper than Apple, Microsoft, and Amazon?

Today’s edition is brought to you by Bitget - We partnered with Bitget to bring you a top offer: deposit at least 100 USDT and instantly claim a 200 USDT trading voucher. Rewards go up to $5,000 for active users—don’t miss it!

This is Smart Money Moves - the newsletter that gives the insights you need to make winning decisions and grow your wealth!

Let's see what we’ll discuss today:

📈 Why is Alphabet cheaper than Apple, Microsoft, and Amazon?

💵 Gold just had its worst week in June — here’s why.

₿ BlackRock just became a Bitcoin whale — quietly.

⚡ North Korea targets crypto workers with new info-stealing malware

Estimated reading time: 5 minutes

DOW: $42,171 (-0.10%)

S&P: $5,980 (-0.03%)

NASDAQ: $19,546 (+0.13%)

Why is Alphabet cheaper than Apple, Microsoft, and Amazon?

Does Alphabet get the respect it deserves?

Not really.

Apple, Microsoft, Amazon?

They’re all trading at a premium.

Alphabet? Discount bin.

(Despite printing better numbers.)

Let’s break it down:

1/ Wall Street’s main fear?

That Google Search is dying.

The logic goes:

Generative AI is replacing it.

Fewer searches → fewer ads → less $$$.

That would be a problem…

If it were true.

2/ Reality check:

Google Search still owns the game.

📉 Market share did dip below 90% for the first time since 2015…

📈 But Search revenue still grew 10% YoY in Q1.

(That’s not what “dying” looks like.)

3/ Alphabet is fighting back with AI.

They’ve added AI search overviews, which blend traditional results with generative summaries.

People love it.

It’s sticky.

It’s monetizable.

4/ But here’s where it gets wild:

In Q1…

Revenue grew 12%

EPS grew 49%

Forward P/E = 18.6x

Now compare that to its big tech peers:

Alphabet is putting up comparable (or better) growth…

Yet trades at a massive discount.

So what gives?

Either:

a) The rest of Big Tech is overvalued,

b) Alphabet is undervalued,

c) Or both.

Either way…

If you want a stock that gives you:

✅ Market dominance

✅ Strong growth

✅ And value pricing

Alphabet might be your best bet.

$GOOG isn’t dying.

It’s loading.

💰 Deposit & Claim 200 USDT Instantly – Up to $5,000 in Rewards!

We’ve partnered with Bitget to bring you a high-value offer!

Here’s how to grab your bonus:

1️⃣ Make your first net deposit of at least 100 USDT

2️⃣ Get an instant 200 USDT Position Voucher (Margin 10, Leverage 20x)

✅ Easy to claim

🎯 Perfect for boosting your first trade

💸 Rewards go up to $5,000 for active users!

👉 Start here: https://bonus.bitget.com/smartmoneymoves

This is a limited-time promotion, perfect for new users looking to start strong with extra firepower in their trading account.

US 10YEAR: 4.41% (+0.02%)

US 2YEAR: 3.95% (+0.01%)

GOLD: $3,356 (-0.51%)

Gold just had its worst week in June — here’s why.

Gold just had its first red week this month.

Here’s why 👇

1/ Geopolitical tensions cooled off.

The Middle East situation?

Less scary now.

Trump is not jumping into Israel vs. Iran (yet).

That means:

→ Less fear

→ Less rush into safe-haven assets like gold

→ Price drop

2/ The Fed played spoiler too.

Powell threw cold water on hopes for rate cuts.

Blame tariffs.

Powell said Trump’s tariff agenda could push inflation up again — making it harder to cut rates.

And if rates don’t drop?

That’s bad news for gold.

(Remember: gold shines when interest rates fall… since it doesn’t yield anything.)

3/ The numbers:

📉 Gold slid >2% on the week

📉 Spot gold at $3,351/oz

📉 Still below April’s record high of ~$3,500

But keep this in mind:

📈 Gold is still up 25%+ YTD

4/ One twist: Platinum’s getting love.

With gold prices already sky-high, some investors are shifting to platinum as the next haven play.

Silver fell.

Palladium popped.

The whole precious metals basket is wobbling.

Bottom line:

Gold just had its first losing week in June.

Why?

→ Middle East fears cooled

→ Fed signaled fewer rate cuts

→ Investors testing new safe havens (like platinum)

But if more chaos hits the headlines…

You already know where the money will run.

BTC: $106,005 (+1.00%)

ETH: $2,553 (+0.56%)

SOL: $148.66 (+1.62%)

BlackRock just became a Bitcoin whale — quietly.

BlackRock’s Bitcoin ETF is quietly becoming a beast.

Yeah, while everyone’s busy arguing on Crypto Twitter…

BlackRock just slid into the top 25 largest ETFs in the world.

Let’s break down what’s happening (and what it actually means for Bitcoin). 👇

1/ The numbers are kinda insane.

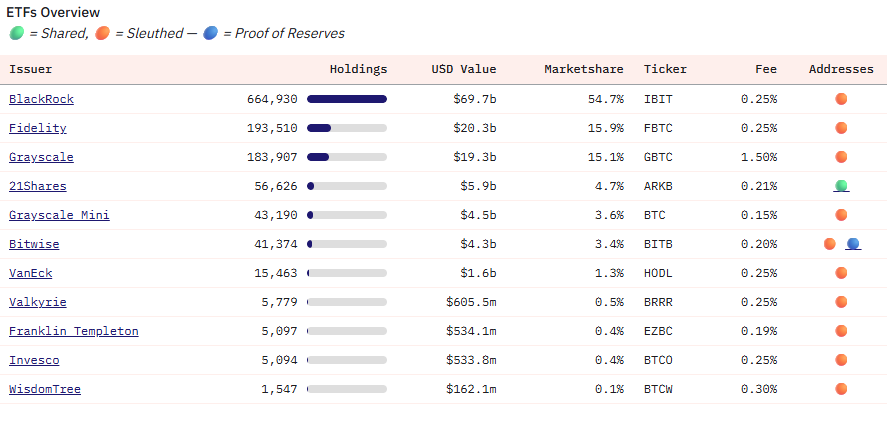

BlackRock’s spot Bitcoin ETF (IBIT) now holds over $69.7 billion worth of BTC.

That’s more than 3.25% of all Bitcoin in existence.

(Yes, all of it. Not just the stuff on exchanges. Everything.)

They’ve taken over half the market share of all U.S. Bitcoin ETFs.

And they did it in less than 18 months.

Casual.

2/ Inflows are still rollin’ in.

U.S. Bitcoin ETFs just posted 8 straight days of net positive inflows.

Wednesday alone? +$388M in fresh BTC.

So while retail investors are slowing down a bit…

Institutions are still backing up the truck.

BlackRock’s IBIT is now ranked #23 among all ETFs globally — not just crypto. All of them.

Let that sink in.

3/ But there’s a catch…

Despite this momentum, Bitcoin’s price action has been kinda meh.

Why?

Well, two things are holding it back:

→ Miners & early holders are cashing out

→ Retail demand is cooling off (short-term holders are down 800k BTC since May)

Translation:

The big dogs are buying, but the party’s missing some fresh faces.

4/ High rollers are taking over the network.

Glassnode says that over 89% of all BTC transactions now involve more than $100K.

The average transaction size? $36,200.

So yeah… fewer meme traders, more suits.

This isn’t your 2017 Bitcoin anymore.

5/ Where’s the bottom if we drop?

According to CryptoQuant, the next strong support level is around $92,000.

Why? That’s the average realized price from onchain traders — kind of like a psychological anchor.

If demand keeps cooling and the sell pressure grows, that’s the line to watch.

TL;DR?

• BlackRock is gobbling up BTC like Pac-Man

• Institutions are in, retail’s kinda tired

• Bitcoin ETF adoption is breaking records

• Price may need a new catalyst to really pop

But one thing’s clear…

The world's largest asset manager is betting big on Bitcoin.

And that should make you pause for a second. 👀

Flash Market Bites ⚡

New to trading? Start on BingX and get 100 USDT instantly after KYC! —up to 3,950 USDT total with active trading. Perfect for new users looking to start strong.*

Cathie Wood Just Bought 3,433,807 Shares of Archer Aviation Stock. Does She Know Something Wall Street Doesn't?

The Arizona Senate has voted to revive House Bill 2324, a Bitcoin reserve bill that initially failed in the House.

Apple has shown consistent movement on certain dates over the years—do you know when? Stock Hotsheets reveal historically significant patterns for top stocks like Walmart and LULU. Find out more today.*

North Korean threat actors have been deploying malware through fake crypto job sites, targeting blockchain professionals to steal wallet credentials.

Here's How Much a $30,000 Investment in the Nasdaq 100 Today Could Be Worth in 30 Years.

Ready to protect your crypto the smart way? The SafePal S1 Pro is your trusted partner for keeping your assets safe. Enjoy peace of mind with top-notch security, all in the palm of your hand.*

* This is partner content.

If you enjoyed reading this newsletter edition, please share it-it’s how Smart Money Moves grows.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

Blackrock is known for politicizing capitalism Leftward. In my opinion, the Lefties naturally support fiat and oppose hard money Bitcoin, because they siphon the value off of the fiat, and use it for Lefty social engineering and vote buying.